KfW’s contribution to digital transformation

Digital technologies of the future are drivers of innovation, competitiveness and growth. They make processes and systems more efficient, increase the ability to react to crises and pave the way for new business models. With its financing instruments and consulting services, KfW invests in a responsible, sustainable and inclusive digital transformation – in developing and emerging economies as well as in industrialised countries.

Infrastructure as a driver for development

KfW supports companies and project partners in the development of innovative technologies and sustainable digital solutions to drive digitalisation and innovation. The spectrum is broad and ranges from the digitalisation of public administration in Rwanda and the promotion of fintechs in Brazil to the financing of highly efficient and sustainable data centres worldwide. An evaluation of the portfolio of KfW subsidiary DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbH from 2023 shows: 76 per cent of its customers contribute to innovation by introducing new technologies, developing new products or implementing new processes.

At the same time, KfW is rigorously pursuing its own digital transformation and innovation agenda: on the one hand in internal processes and, on the other hand, at the interfaces with customers and partners, where it is driving forward the expansion of digital platforms and applications.

KfW...

- supports its partners in the digital transformation with grants, concessionary loans and policy-based financing;

- finances projects in all sectors, including education and health, energy and water, climate action and also supports technology start-ups;

- drives forward digitalisation and innovation internationally as a project and export financier through its subsidiary KfW IPEX-Bank by financing infrastructure projects such as the expansion of broadband or 5G networks as well as investments in data centres;

- funded 52 new development cooperation projects in 20234 with a volume of around EUR 1.7 billion. The current portfolio comprises about 450 projects with a volume of around EUR 15 billion;

- contributes to digitalisation and innovation through its subsidiary DEG with financing and consultancy services for private German companies in developing countries and emerging economies.

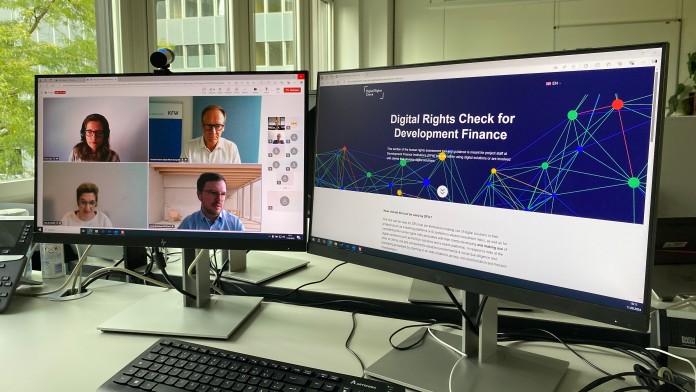

Ethical aspects of digitalisation

New technologies can positively influence many aspects of human development. Digital identity systems and health services, for example, are crucial for expanding public services and increasing their efficiency. Digitalisation also promotes financial participation and education. It thus contributes to the achievement of the UN Sustainable Development Goals.

In addition to the widespread potential of digitalisation, there are also risks – for example with regard to data and customer protection, data misuse, misinformation or discrimination by algorithms. Companies and project partners investing in innovation and digitalisation often face a challenge: How can such risks be identified and how can they be managed responsibly? Special tools are required to mitigate risks and complement the usual audit processes in the area of environmental and social sustainability.

In this context, KfW, as a bank committed to responsibility, provides assistance. It has developed several guidelines and tools for managing technological progress in a risk-conscious manner and makes them publicly available.

Support for companies and export financing

KfW is thus committed to effectively managing digital risks and upholding human rights standards. With digital transformation accelerating, it is imperative that partners and customers adopt these applications and integrate them into their business operations – with the aim of fostering a culture of proactive risk management and ethical digital development.

Examples of projects

Further information

Status: 13 February 2025

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw.de/s/enkB4UgD

Copy link Link copied